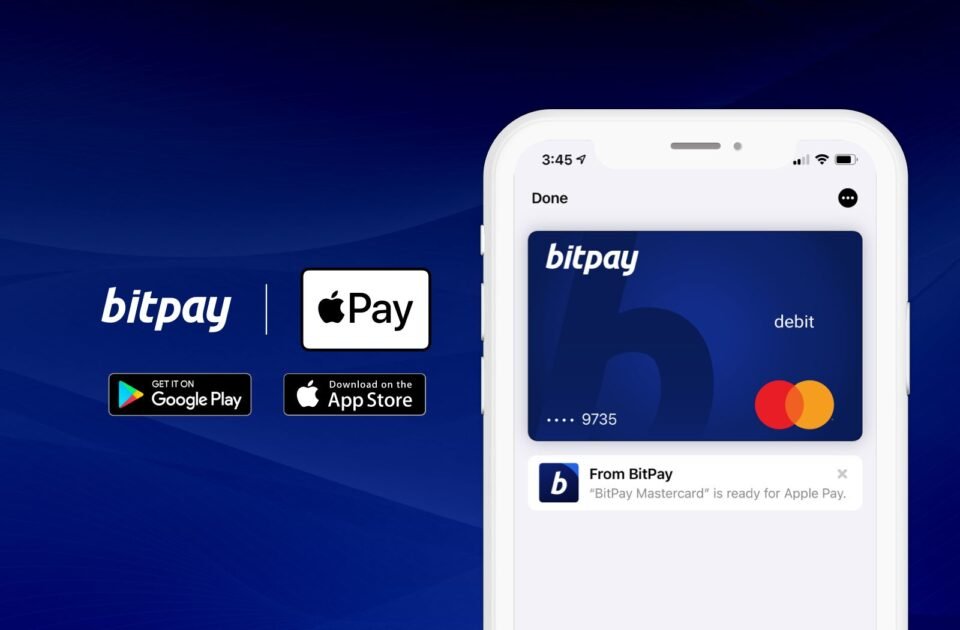

BitPay, a leading payment processor for the digital currency industry, has announced support for Apple Pay for prepaid Mastercards. BitPay has been supporting virtual card platforms for merchants for some time now. These virtual card platforms allow merchants to accept digital currencies from customers in a secure and convenient way. Read this article to know more about virtual card platforms and how they can help you accept payment from your customers in a secure and convenient way. BitPay is a Bitcoin payment processor that supports many other virtual currencies, such as Ethereum and Litecoin. It’s one of the most popular payment processors for merchants as well as individual users. Bitcoin and other virtual currencies are now accepted by more than 100,000 merchants worldwide. BitPay has been supporting virtual card platforms for merchants so that they can accept digital currencies from customers in a secure and convenient way. It announced the availability of the Apple Pay support for BitPay Prepaid Mastercards on January 18, 2018. The new feature is available to users in the Apple Wallet app

What is a Prepaid Mastercard?

A prepaid Mastercard is a card that you load money onto before it expires. It is similar to a gift card and is convenient because it allows you to purchase goods or services and then “cash out” the amount that you want. Some companies will even send you a paper statement each month indicating how much money you have loaded onto your card.

Sarah Ross, Co-founder of CocoLoan commented that BitPay, a cryptocurrency payment service provider, has announced that its prepaid card now supports Apple Pay for in-store, in-app, and online payments. Users of the service can now add the BitPay Prepaid Mastercard to their Apple Pay wallets.

How to process payments with a Prepaid Mastercard?

Customers can fund their prepaid cards on their website or app, and then use a link sent to their device to buy something with the money loaded onto their card. For example, if you have a website and you sell a digital good for $10, you can let the customer buy it with their $10 from the card. You don’t need to handle the transaction, you just pass that $10 onto the customer. Then the customer uses the card to send you the $10. This is the most basic way to use a prepaid card. Some virtual card platforms, like BitPay, will even let you create a branded card that can be used to purchase other products. Convert USD to BTC

How to get a BitPay Prepaid Mastercard?

You can sign up for a BitPay Prepaid Mastercard by creating an account with a virtual card provider like BitPay. Each provider has their own process for creating an account, but they all follow the same basic steps. You will need to upload your photo and application, and then answer some questions about yourself. Once you have an account, the process is fairly simple. You load funds onto the card, then use the card like a physical card.

The BitPay Card Review

The BitPay card has several benefits for the users. The first one is the lack of fees for every transaction that you make. This means that you won’t have to think about fees as much when you are using it. For example, if you are using it to make a payment from one country to another, then you don’t have to pay any fees. The second benefit is that it allows you to spend some money online, and then “cash out” the funds that you have loaded onto the card. For example, if you are a traveler and you decide to visit some places in your hometown, you can load the funds on the card and then “cash out” the funds. This way you won’t have to spend money on taxis just to visit some places like you would have to if you were using a physical card.

BitPay Card benefits

BitPay card benefits include the ability to load funds on the card, use it like a physical card, and then “cash out” the amount. This way you won’t have to spend money when you are visiting the places in the town or visiting your friends or family. You can also use the card to shop online and then use the “cash out” feature to get the amount back. The best part about the card is that there are no fees for using it.

Disadvantages of BitPay Card

The disadvantages of the BitPay card include that it is not as easy to get as a traditional card and that you will have to go through security verification every time you load funds on the card. The verification is slightly more complicated than the verification for a traditional card, but it won’t take more than 30 seconds.

Final Words

BitPay has been supporting virtual card platforms for some time now. These virtual card platforms allow merchants to accept digital currencies from customers in a secure and convenient way. With the Apple Pay support for BitPay Prepaid Mastercards, now you can accept payment from your customers using their Apple Pay-enabled smartphones. The new feature is available to users in the Apple Wallet app on their iOS devices. You can also accept payment from your customers using their Android smartphones with the help of a BitPay Card. The new feature is available to users in the Android Pay app on their Android devices.